Adding dollars and sense to the three Rs

Ohio youngsters are largely clueless when it comes to saving and budgeting. The new Smart Ohio

Financial Literacy pilot program developed by the UC Economics Center aims to change that.

by Rachel Richardson

513-556-5219

July 22, 2016

When Ohio elementary school students head back to class this fall, nearly 15,000 of them will encounter a new curriculum that teaches old-school lessons on saving money and budgeting through a fun and innovative new media.

The Smart Ohio Financial Literacy pilot program, developed by the University of Cincinnati Economics Center, will be offered to schools statewide this fall, thanks in part to a $318,000 grant passed with overwhelming bipartisan support from Ohio’s House and Senate and signed last month by Gov. John Kasich.

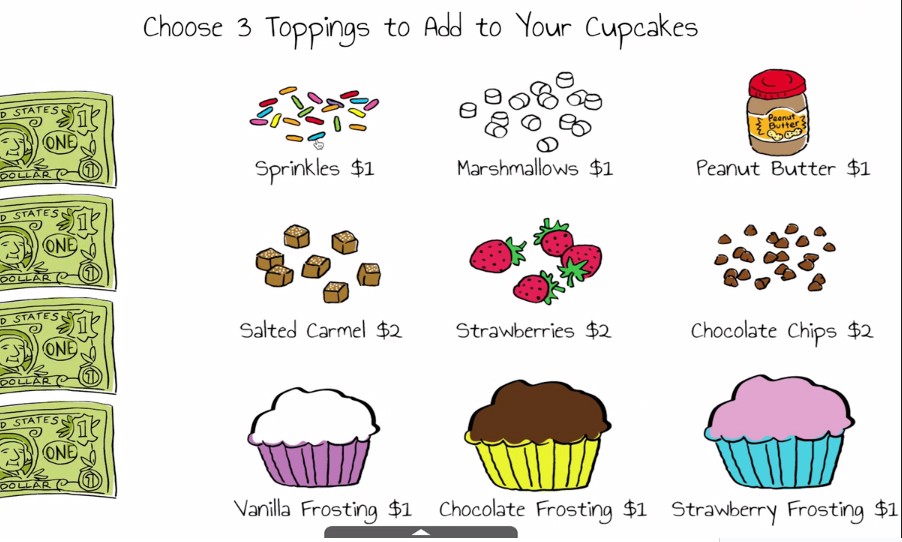

The program centers on $martPath, a new online curriculum offered free of charge to educators and students across the globe that incorporates lessons on both economic and financial literacy in an interactive curriculum tailored to students in grades 1-6.

The $1 million venture, which launched last fall, represents the most ambitious project to date for the UC Economics Center, the largest of more than 200 university-based economics education centers in the country.

The center spent more than a year developing the award-winning software as part of its larger efforts to inject an “F” into the three Rs: reading, writing, arithmetic and finance.

.

Economist Julie Heath took on that challenge when she became director of the center in 2012. The award-winning educator based the Smart Ohio program on one she previously developed in Tennessee, which helped earn her the 2010 Tennessee Professor of the Year award by the Carnegie Foundation.

After her move to the Buckeye state, Heath immediately set to work lobbying Ohio legislators about the need for financial literacy education for elementary age students.

While Ohio requires students to complete six weeks of economic and personal finance education, the instruction is often embedded in other courses, like social studies or even health classes, and only offered at the high school level. That’s too little and too late, says Heath.

Lessons on acquiring good money habits, setting financial goals and understanding concepts like risk and reward need to come at a much earlier age, she insists.

“Can you imagine someone saying that six weeks of math embedded in another course is plenty for our students to have?” said Heath. “We don’t treat any other subject the way we treat financial education.”

A 'win-win' for students

Marsha Piphus, a special education intervention specialist with Cincinnati Public Schools, encountered rave reviews from students when she began using $martPath in her fourth through sixth grade classrooms earlier this year.

Although many of her tech-savvy students can text, Tweet and Snapchat with ease, most are downright clueless about basic concepts like saving and budgeting, she says.

“In many cases, students in my building are not exposed to financial literacy concepts at home,” she wrote in a letter to Ohio legislators urging them to support the program. “They talk about poor decision-making practices. Being able to include this program in our curriculum is only a win-win.”

“Not only does it talk about financial literacy, it goes over other skills as well, such as math. I can also integrate it into comprehension skills, decision-making and writing skills,” she added.

$martPath meets both Ohio’s new Common Core-based learning standards and national standards in K-12 personal finance education set by JumpStart, a nonprofit organization dedicated to financial education.

State funding for the Smart Ohio pilot program will provide for stipends to allow educators to attend trainings on how to incorporate $martPath in their classrooms and effectively use the software’s pre- and post-assessment features to gauge student progress.

Heath said the goal is to train 500 Ohio teachers this academic year and become part of the state’s permanent budget moving forward.

Piphus said she plans to continue using the software in her classroom and encourages other educators to do the same.

“Our school budgets are very limited. It’s free and the kids love it — it’s perfect,” she said.

$martPath, an online software developed by the UC Economics Center to teach personal finance and economics education to students in grades 1-6, features story-based curriculums and student assessments.

What Teachers and Students Say

Educators and elementary school students across Ohio wrote to state legislators urging them to support the Smart Ohio Literacy Program. Here's what they had to say about $martPath, the interactive online software at the heart of the curriculum:

Teachers

"The pilot program was a game changer for my students. My students enjoyed every lesson and talked about the way in which they would spend their money. They wanted to watch the next video and liked the characters presented. Overall, the curriculum was positive in every way."

Kelly Hughes, special education intervention specialist, North College Hill Elementary School

"It was wonderful to know that this was available and in place for me to use without having to search for internet resources or use materials that did not relate to other curricular areas. I found it to be of high quality and value added as a way to teach my students about financial literacy."

Beth Wernery, elementary teacher, Hilltop Elementary, Reading Community Schools

"This curriculum helped us meet the standards and also created connections to mathematics and language arts as well. The students enjoyed the lessons and looked forward to the next lesson. They came to class with questions and often said that they would be going home to talk to their parents about the lessons learned."

Noelle Georgantonis, elementary teacher, Pleasant Run Elementary, Northwest Local Schools

Students

"$martPath changed my life. It's taught me how to save money, what to spend the money on, how to earn money and how to make good decisions." -Khamari

"I like SmartPath because it was easy to understand. I learned how to earn, save and spend money. It told me how to have plan and goals for my money. I want to do more work with SmartPath." -Ryan

"When you were in fourth grade did you learn about economics and personal finance? I am this year. It is fun and I am learning so much. Please help me learn more by supporting SmartPath." -Nyla

"I really enjoyed it. There's a lot of things that I can do with my money such as... ideas to get more money, job list of earning money, earn money, save money, spend money. Smartpath told me a lot of information of what to do with my money." -Kylie

"I am having fun learning about money. I learned I could save, spend or donate money. I want to learn more about economics and personal finance." -Olivia

Any teacher can sign up to use $martPath

All $martPath units of study:

- Are relevant and deliver on Ohio Learning Standards outcomes

- Include embedded assessments so you can track and report on student progress

- Are fun, simple-to-run and quick so they fit into your teaching program

- Are high-quality, interactive and engaging

Sign up or login, and start exploring and using the resources today!