Marketing students start their own company

Scholarship provides powerful opportunities

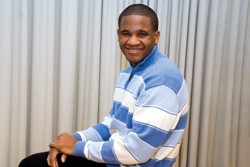

LaVandez Jones, Bus '08, may be the next Donald Trump some day, just without the catchphrases and the conspicuous comb-over. Not only has Jones studied global business issues in China and Europe, but the junior marketing and finance student has teamed up with another College of Business student to create their own investment company.

Issue Archive

Issue Archive